May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

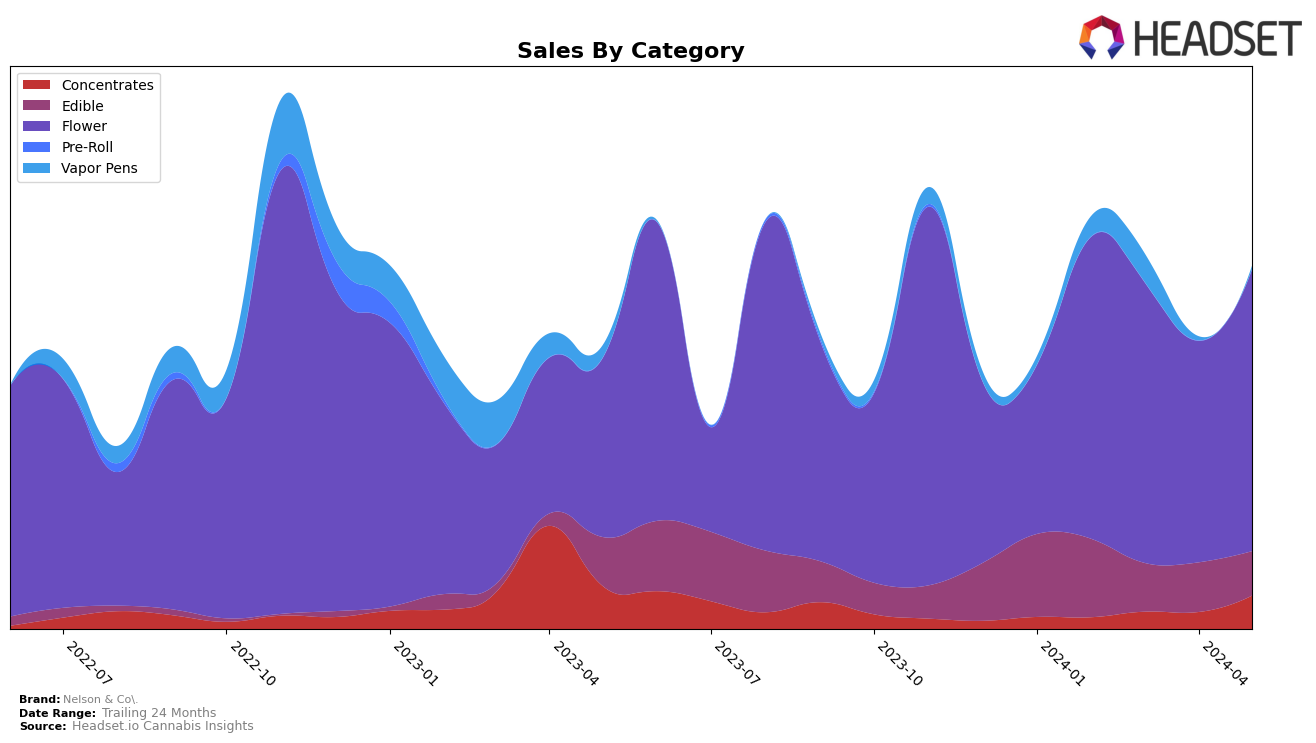

Nelson & Co. has shown varying performance across different product categories and states. In the Oregon market, the brand's presence in the Concentrates category was notably absent from the top 30 rankings over the past four months, indicating a potential area for growth or a need for strategic realignment. Conversely, Nelson & Co. maintained a consistent presence in the Edible category, ranking 25th in February and fluctuating slightly to 28th by May. Despite the drop in rankings, this category has shown resilience and steady sales, suggesting a loyal customer base for their edible products.

In the Flower category, Nelson & Co. experienced a significant drop in rankings, moving from 74th place in February to 99th in April, before climbing back to 84th in May. This volatility might reflect market competition or seasonal demand shifts. However, the sales figures for May indicate a recovery, with sales reaching close to those in February, suggesting that the brand is capable of bouncing back. The data highlights areas where Nelson & Co. can focus its efforts to improve market share, especially in the Concentrates category where they are currently not among the top 30 brands.

Competitive Landscape

In the Oregon Flower category, Nelson & Co. has experienced fluctuating rankings over the past few months, indicating a competitive and dynamic market. Starting at rank 74 in February 2024, Nelson & Co. saw a decline to 91 in March and further to 99 in April, before recovering slightly to 84 in May. This volatility suggests challenges in maintaining consistent market presence. In contrast, Oregrown maintained a stronger position, starting at rank 28 in February and only dropping to 61 by May, reflecting more stable sales performance. Drewby Doobie / Epic Flower also showed variability, with a notable absence from the top 20 in April, but reappearing at rank 92 in May. Meanwhile, Kites demonstrated a positive trend, improving from rank 94 in February to 52 in April, before settling at 80 in May. The competitive landscape highlights the need for Nelson & Co. to strategize effectively to improve its rank and sales amidst strong competitors.

Notable Products

In May-2024, the top-performing product for Nelson & Co. was GMO (Bulk) in the Flower category, securing the number one rank with 2407 units sold. Strawberry Carefree Rosin Jelly (100mg) in the Edible category climbed to the second position, up from third in April-2024, with notable sales of 1044 units. Blueberry Hash Rosin Carefree Jelly (100mg), also in the Edible category, maintained a steady presence at the third rank. Sour Green Apple Carefree Rosin Jelly (100mg) experienced a drop from first place in April-2024 to fourth in May-2024. Hash Burger (Bulk) in the Flower category saw a significant decline from second in April-2024 to fifth in May-2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.