Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

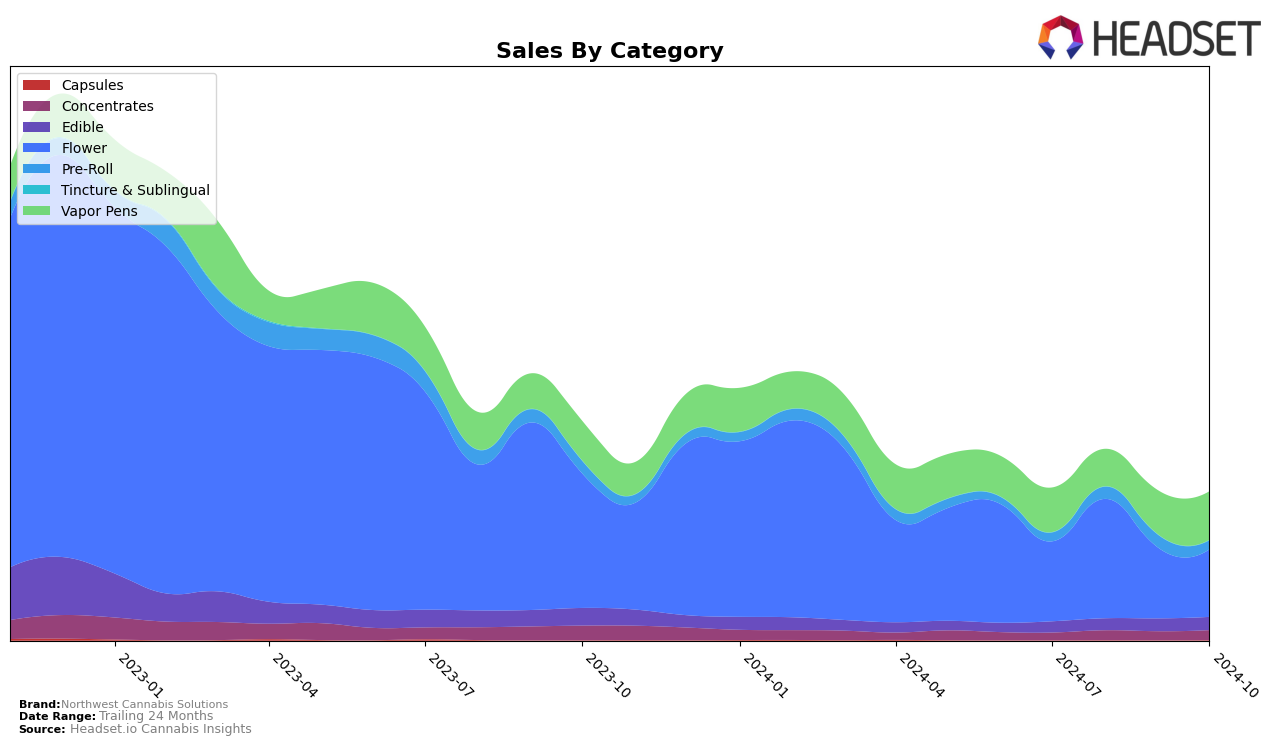

Northwest Cannabis Solutions has shown varied performance across different states and product categories over the past few months. In Colorado, the brand's presence in the Flower category has seen a decline, with rankings slipping from 58th in August 2024 to 78th by October 2024. This drop in ranking is accompanied by a decrease in sales figures, indicating a challenging competitive environment or potential shifts in consumer preferences within the state. The absence of the brand in the top 30 rankings for July highlights a struggle to maintain a strong foothold in the Colorado Flower market.

In contrast, Washington presents a more stable picture for Northwest Cannabis Solutions, particularly in the Edible category, where the brand consistently held the 34th position, except for a slight improvement to 32nd in September 2024. This consistency suggests a steady consumer base for their edibles in Washington. However, the brand's performance in the Vapor Pens category has been more dynamic, with rankings fluctuating from 94th in July to 87th by October, alongside an upward trend in sales. The significant absence of the brand from the top 30 in the Concentrates category in Washington indicates potential areas for growth or reevaluation of market strategies.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Northwest Cannabis Solutions has shown a positive trajectory in recent months, climbing from a rank of 94 in July 2024 to 87 by October 2024. This upward trend in rank is accompanied by a consistent increase in sales, indicating a strengthening market position. Despite this progress, Northwest Cannabis Solutions faces stiff competition from brands like DOJA, which improved its rank from 98 in August to 85 in October, surpassing Northwest Cannabis Solutions in both rank and sales. Meanwhile, Constellation Cannabis experienced a slight dip in October, falling to 88, which could present an opportunity for Northwest Cannabis Solutions to further improve its standing. Additionally, K Savage (WA) and Ballin Cannabis have shown fluctuating ranks, with K Savage (WA) dropping from 73 in July to 90 in October, and Ballin Cannabis making a notable entry at 84 in October. These dynamics suggest a competitive but volatile market, where strategic positioning and consistent performance could enable Northwest Cannabis Solutions to continue its ascent.

Notable Products

In October 2024, Blue Dream (7g) maintained its top position in the Flower category, despite a decrease in sales from the previous month. Blue Dream Distillate Cartridge (1g) climbed to second place in the Vapor Pens category, showing a steady increase with sales reaching 614 units. Magic Kitchen - Indica Caramel Chews (100mg) advanced to the third position in the Edible category, reflecting a notable rise in sales compared to September. Honey Infused Blunt (1g) experienced a drop to fourth place in the Pre-Roll category, while White Grape Infused Blunt (1g) fell to fifth, indicating a decline in sales performance. Overall, Northwest Cannabis Solutions saw dynamic shifts in product rankings, with some products gaining traction while others faced challenges.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.