Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

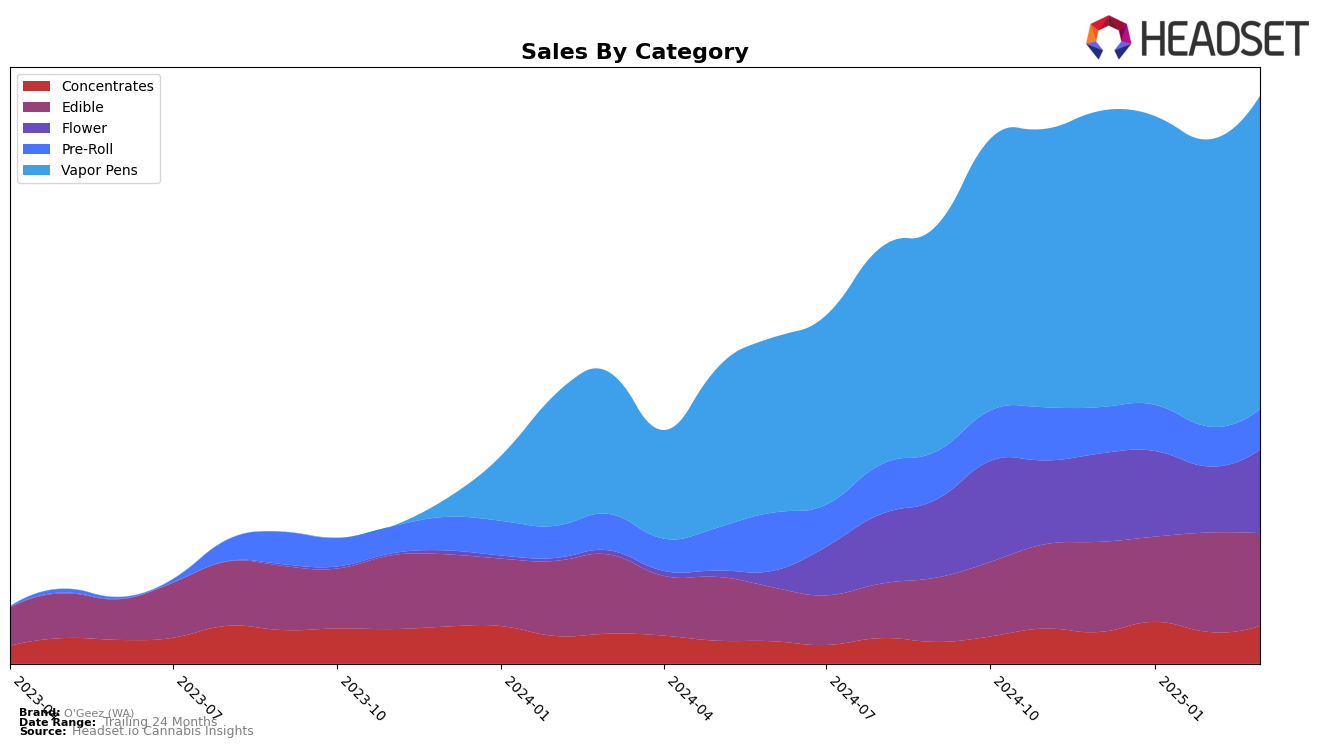

O'Geez (WA) has shown varying performance across different states and categories, with notable movements in rankings. In Arizona, the brand's presence in the Edible category maintained a steady position within the top 30, fluctuating slightly but consistently ranking between 24th and 28th from December 2024 to March 2025. This indicates a stable but slightly downward trend in the competitive Arizona market. Meanwhile, in Illinois, O'Geez (WA) was not in the top 30 in January 2025, but it managed to climb up to 52nd and 53rd in February and March, respectively, demonstrating a significant upward movement in the Edible category despite the overall lower sales figures compared to Arizona.

In Washington, O'Geez (WA) has had mixed results across categories. The brand has shown a strong presence in the Vapor Pens category, improving its rank from 24th in December 2024 to 18th by March 2025, indicating a positive growth trajectory and a strengthening foothold in this segment. Conversely, the Flower category has seen a more volatile performance, with rankings fluctuating from 97th to 87th over the same period, suggesting challenges in maintaining a stable position. The Pre-Roll and Concentrates categories have shown some stability, with slight improvements or consistent rankings, reflecting a resilient performance despite the competitive landscape in Washington.

Competitive Landscape

In the competitive landscape of Vapor Pens in Washington, O'Geez (WA) has shown a promising upward trajectory in the rankings from December 2024 to March 2025. Starting from a rank of 24 in December, O'Geez (WA) improved to 18 by March, indicating a positive trend in market presence. This rise in rank is noteworthy when compared to competitors like Fire Bros., which saw a decline from 13 to 19 during the same period, and Cookies, which struggled to maintain a consistent rank, hovering around the 20th position. Meanwhile, AiroPro showed a slight improvement, moving from 19 to 17, and The Capsule Collection maintained a steady presence, slightly improving from 17 to 16. The consistent sales growth of O'Geez (WA), especially in March 2025, where it surpassed its competitors in terms of sales momentum, suggests a strengthening brand appeal and market strategy that could continue to elevate its position in the Washington Vapor Pens category.

Notable Products

In March 2025, the top-performing product from O'Geez (WA) was the CBD/THC 1:1 Strawberries & Cream Gummies 10-Pack with a consistent rank of 1 across the past four months and sales of 7003 units. The Granddaddy Purple Distillate Disposable maintained its second-place position, though its sales have slightly decreased. The Blue Dream Distillate Cartridge climbed from fifth place in previous months to third, indicating a rise in popularity. Pineapple Express Distillate Cartridge consistently ranks fourth, showing stable performance since its introduction in February. White Widow Distillate Cartridge, entering the rankings at fifth place, has shown a steady entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.