Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

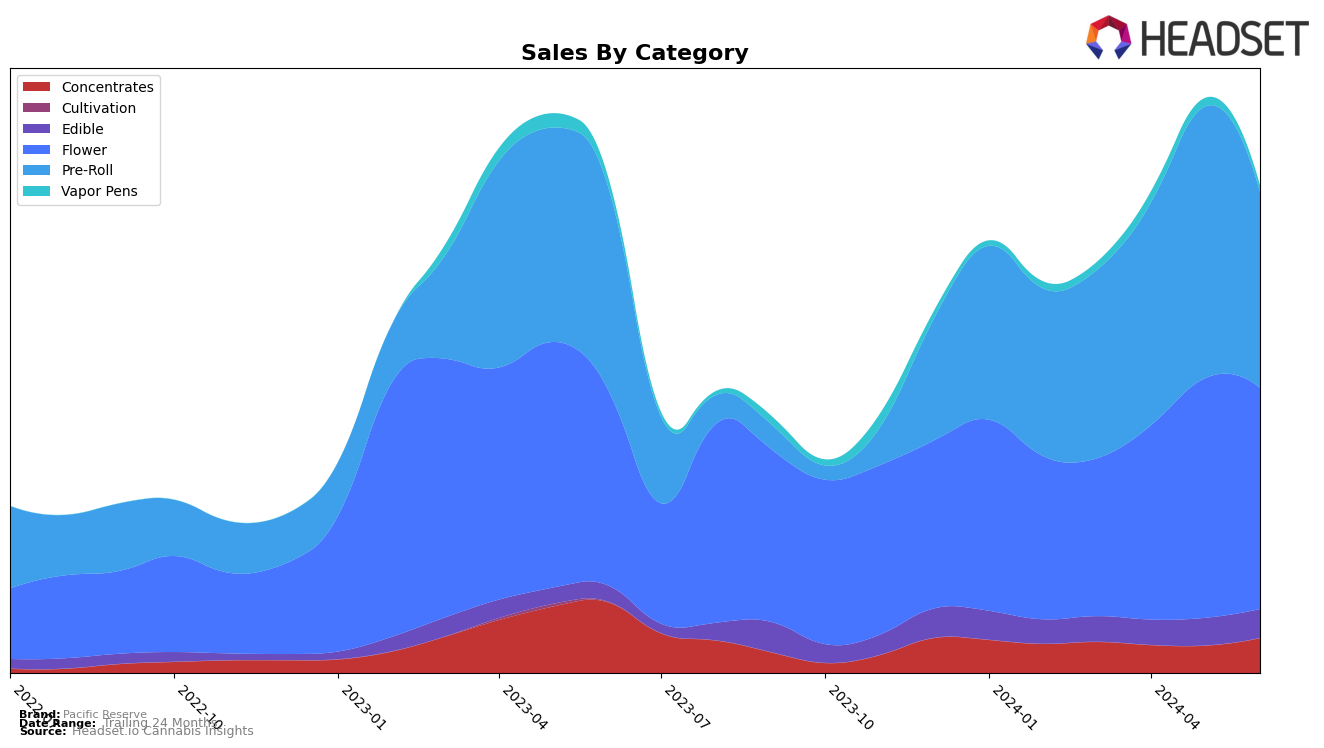

Pacific Reserve has shown a notable performance in the California market across various categories. In the Concentrates category, the brand has moved from the 29th position in March 2024 to the 21st position by June 2024, demonstrating a positive trend with a significant jump in ranking. This improvement is further reflected in their sales, which have seen an increase from $152,240 in May to $194,277 in June. In the Edible category, Pacific Reserve has also made strides, moving from the 32nd position in March to the 27th position in June. Although this category shows a slower upward movement, the brand's ability to break into the top 30 is a positive indicator of its growing presence in the market.

In the Flower category, Pacific Reserve has experienced fluctuations in its rankings within California. Starting at the 34th position in March, the brand climbed to the 22nd position in May, but slightly dropped to the 25th position in June. Despite this minor setback, the overall trend from March to June shows substantial growth. On the other hand, the Pre-Roll category presents a more volatile picture; Pacific Reserve achieved an impressive 8th position in May but fell to the 14th position in June. This category's performance suggests a need for the brand to stabilize its market presence to maintain a top-tier ranking consistently.

Competitive Landscape

In the competitive landscape of the California flower category, Pacific Reserve has shown notable fluctuations in rank and sales over the past few months. Starting from a rank of 34 in March 2024, Pacific Reserve improved significantly to 22 in May 2024, before slightly dropping to 25 in June 2024. This upward trend in the earlier months indicates a strong market presence and increasing consumer preference. However, competitors like Rio Vista Farms and Astronauts (CA) have maintained relatively stable ranks, with Rio Vista Farms consistently staying within the top 30 and Astronauts (CA) hovering around the mid-20s. Ember Valley has shown a slight decline, moving from rank 23 in March to 26 in June 2024. Interestingly, Gramlin made a significant leap from rank 84 in April to 27 in June, indicating a potential rising competitor. These dynamics suggest that while Pacific Reserve is performing well, it faces stiff competition from both stable and emerging brands, necessitating strategic marketing and product differentiation to maintain and improve its market position.

Notable Products

In June 2024, Barracuda Bubbles Pre-Roll (0.7g) emerged as the top-performing product for Pacific Reserve with notable sales of 10,432 units. Following closely, Zanimal Punch Pre-Roll (0.7g) secured the second position. Banana Jealousy (3.5g) rose to the third rank from its previous fifth position in March and April, indicating a positive trend in its sales performance. Blue Razz Fizz Pre-Roll (0.7g) and Honey Pancake Pre-Roll (0.7g) occupied the fourth and fifth spots respectively. The data shows a strong preference for pre-rolls among consumers, with four out of the top five products belonging to this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.