Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

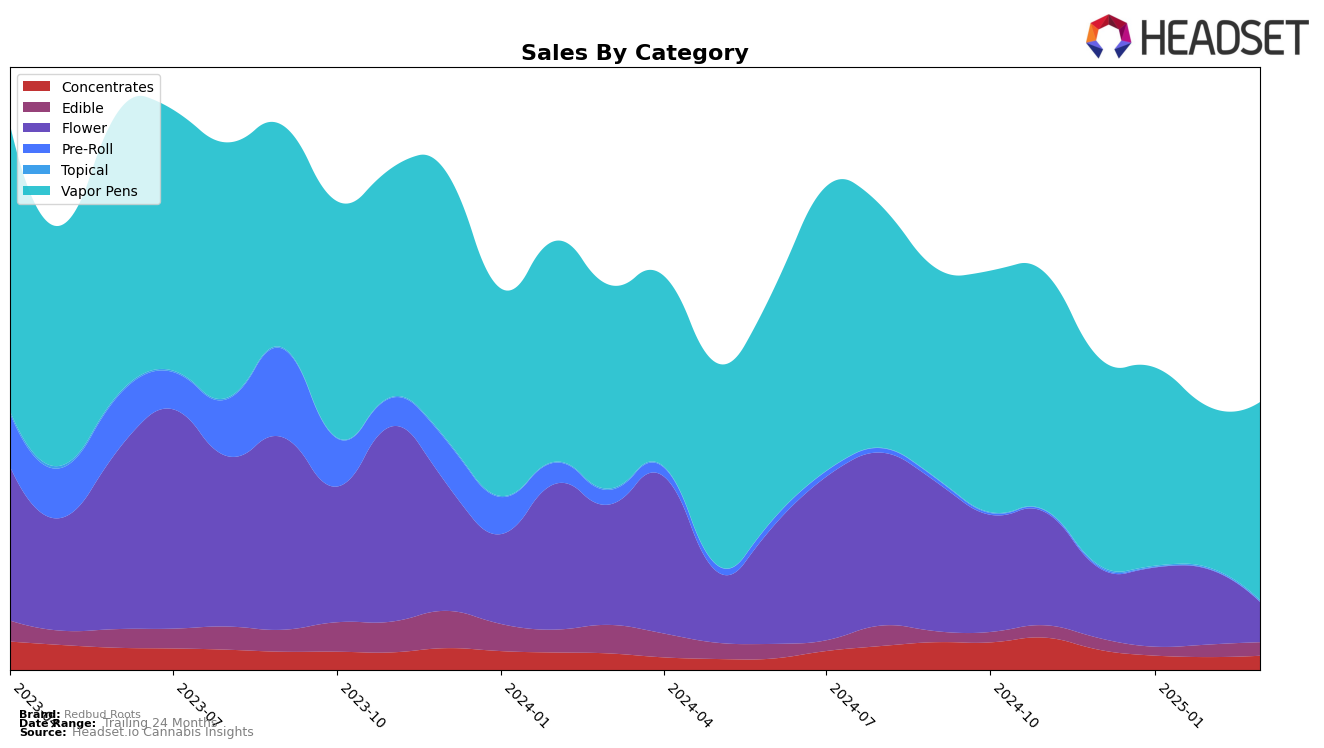

Redbud Roots has shown varied performance across different categories and states, reflecting both opportunities and challenges in their market presence. In Illinois, the brand has maintained a consistent presence in the Vapor Pens category, with a ranking improvement from 22nd in December 2024 to 19th by March 2025. This upward trend aligns with a notable increase in sales, indicating a strengthening foothold in this category. However, the Edible category in Illinois tells a different story, where Redbud Roots has not been able to break into the top 30, as indicated by their ranking hovering in the mid-40s. This suggests an area where the brand might need to strategize for better market penetration.

In Michigan, Redbud Roots has experienced a mixed bag of results. The Vapor Pens category has seen stability, with the brand consistently ranking at 21st place over the months, suggesting a steady consumer base. Conversely, the Concentrates category reveals a downward trend, with the brand slipping from 36th to 52nd place from December 2024 to March 2025, indicating a potential loss of market share. In the Flower category, Redbud Roots showed some promise by improving their rank from 75th to 59th by February 2025, although they failed to maintain a top 30 position by March, which could imply a need for renewed focus on this segment to capitalize on any upward momentum.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Redbud Roots has shown a dynamic performance over the past few months. Starting from December 2024, Redbud Roots was ranked 22nd, but it improved its position to 18th in January 2025, indicating a positive reception in the market. However, the brand experienced a slight dip in February 2025, falling back to 22nd, before rebounding to 19th in March 2025. This fluctuation in rank suggests a competitive environment where brands like Good News and Crystal Clear consistently maintained higher ranks, with Good News holding steady between 16th and 17th place. Despite these challenges, Redbud Roots' sales in March 2025 surpassed those of High Supply, indicating a strong market presence and potential for growth. The brand's ability to rebound in rankings and increase sales amidst fierce competition highlights its resilience and adaptability in the Illinois vapor pen market.

Notable Products

In March 2025, the top-performing product for Redbud Roots was the Pure THC Distilled Full Spectrum Cartridge (1g) in the Vapor Pens category, maintaining its consistent first-place position from previous months with sales of 10,038 units. The Mango Trees FSE Distillate Cartridge (1g) emerged as the second-ranked product, making its debut in the rankings. The CultivArt - Ultra Blue Dream BDT Distillate Cartridge (1g) secured the third spot, having re-entered the rankings after being unranked in February. The Trainwreck HTFSE Cartridge (1g) dropped one position to fourth place compared to February. Finally, the CultivArt - Snoop Dawg BDT Distillate Cartridge (1g) maintained its fifth-place rank, showing a steady performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.