Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

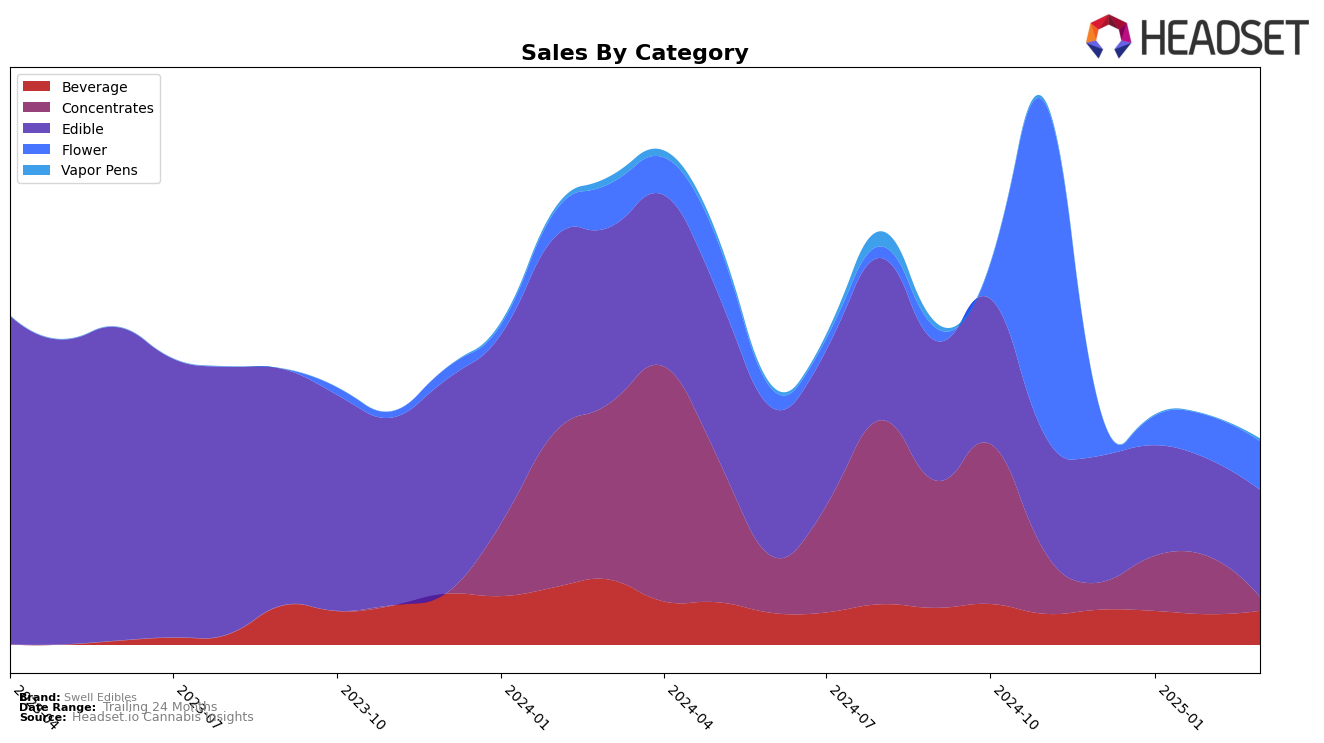

In Arizona, Swell Edibles has shown a dynamic performance across different categories. Notably, in the Concentrates category, the brand climbed from a rank of 40 in December 2024 to 31 in January 2025, before slightly dropping to 32 in February. However, by March 2025, they fell out of the top 30, indicating a potential area for improvement. In contrast, Swell Edibles' performance in the Flower category is commendable, as they improved their ranking from 68 in December 2024 to 58 by March 2025, showcasing a steady upward trend. The sales figures reflect this positive movement, with a notable increase in sales from January to March 2025.

In Washington, Swell Edibles maintained consistent rankings in the Beverage category, holding steady at 14th place from December 2024 through March 2025. This stability suggests a strong foothold in this segment, despite a slight dip in sales in February. Meanwhile, in the Edible category, the brand experienced a minor drop in rankings, moving from 21st place in December 2024 to 22nd in February and March 2025. This indicates a need for strategic initiatives to regain their earlier position. Overall, while Swell Edibles demonstrates strength in certain areas, there are opportunities for growth and increased market presence in others.

Competitive Landscape

In the competitive landscape of the edible category in Washington, Swell Edibles has experienced some fluctuations in its market position, ranking 21st in December 2024 and January 2025, before dropping to 22nd in February and March 2025. This shift indicates a slight decline in their competitive standing, potentially impacted by the performance of other brands. For instance, Happy Cabbage Farms has shown a consistent climb, maintaining a rank of 21st in February and March 2025, suggesting a strengthening market presence. Meanwhile, Mari's has remained steady at the 20th position, while Hi-Burst and Koko Gemz have not breached the top 20, indicating a more challenging competitive environment for these brands. Swell Edibles' sales figures reflect a downward trend from December 2024 to February 2025, with a slight rebound in March, which may suggest the need for strategic adjustments to regain and enhance its market position.

Notable Products

In March 2025, Gold - Banana OG (3.5g) emerged as the top-performing product for Swell Edibles, climbing from a rank of 5 in December 2024 and February 2025 to secure the number 1 spot with sales reaching 1030 units. Hybrid Watermelon Fruit Chews 10-Pack (100mg) maintained a strong performance, ranking second, showing a consistent presence in the top 3 since December 2024. Banana Sniffer Budder (1g) experienced a drop to third place in March after leading in February. KEEN - Blue Raspberry Indica Cannabis Shot (100mg THC, 1.75oz) entered the top 5 at fourth place, while Indica Mystery Fruit Chews 10-Pack (100mg THC, 1.16oz) rounded out the top 5. Notably, the Gold - Banana OG's impressive leap to the top position underscores a significant increase in its popularity and sales volume.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.