Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

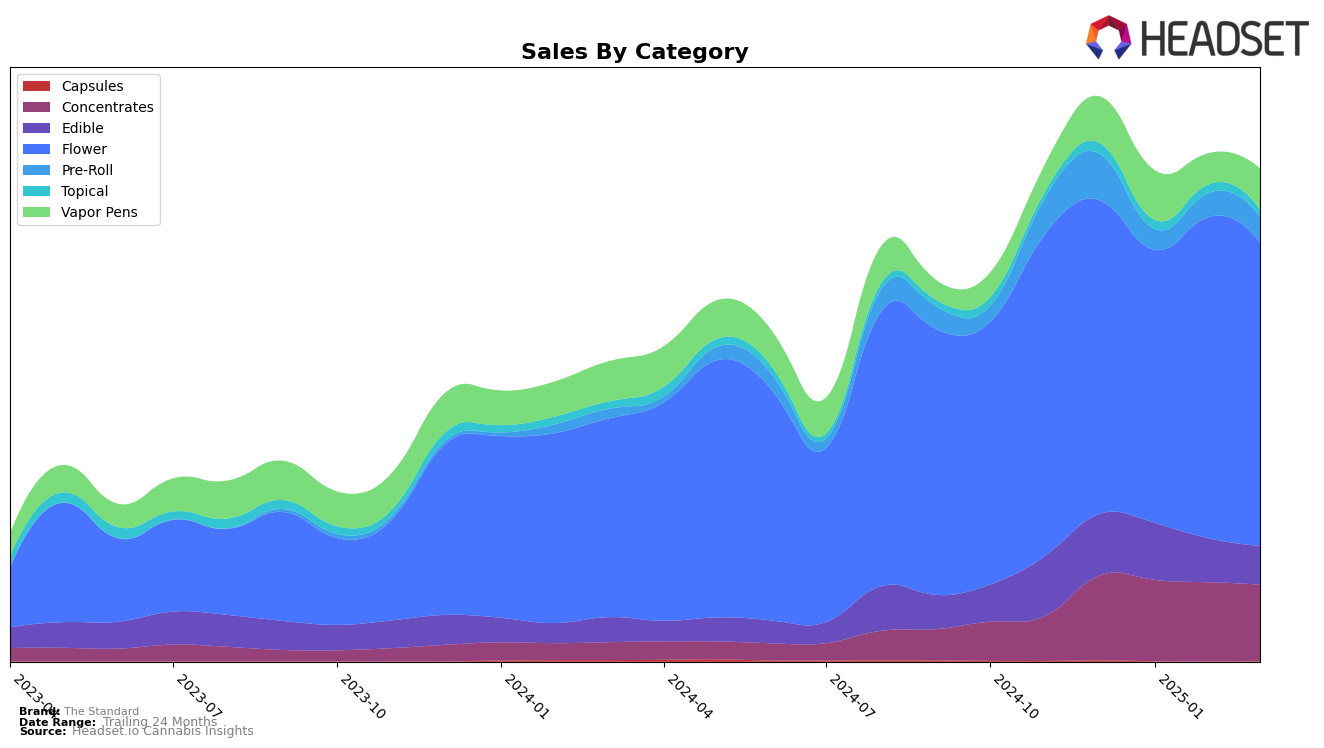

The Standard has demonstrated varied performance across different categories and states. In Missouri, the brand's presence in the Concentrates category saw a slight improvement, moving from 23rd place in February 2025 to 20th place in March 2025. However, their performance in the Edible category remained stagnant, as they hovered around the 31st and 32nd positions without breaking into the top 30. The Flower category, however, showed consistent improvement, climbing from 25th in January to 19th by March, indicating a strengthening foothold in that segment. On the other hand, The Standard's rank in the Pre-Roll category in Missouri dropped significantly, from 22nd in December 2024 to 38th by March 2025, suggesting potential challenges in maintaining market share in that segment.

In Ohio, The Standard's performance in the Concentrates category was notably strong, consistently ranking within the top 6, peaking at 3rd in February 2025 before settling at 5th in March 2025. This indicates a robust presence and possibly a loyal customer base in this category. However, the Edible category tells a different story, with a downward trajectory from 17th place in December 2024 to 28th by March 2025, highlighting potential areas for improvement. In Vapor Pens, the brand's rank declined, ending up outside the top 30 by March, which might reflect increased competition or shifting consumer preferences. Interestingly, the brand did not maintain its presence in the Topical category past December 2024, where it was ranked 5th, suggesting either a strategic withdrawal or a shift in focus away from this category.

Competitive Landscape

The Standard has shown a notable improvement in its rank within the Flower category in Missouri, moving from 25th place in January 2025 to 19th place by March 2025. This upward trajectory is indicative of a positive trend in sales, as evidenced by a significant increase from January to March. In comparison, TwentyTwenty (IL) experienced fluctuations, peaking at 19th in February before dropping to 21st in March, suggesting a less stable performance. Meanwhile, C4 / Carroll County Cannabis Co. maintained a relatively stable rank, hovering around 16th and 17th, indicating consistent sales performance. Proper Cannabis saw a decline from 14th in December to 18th by March, reflecting a downward sales trend. Nuthera Labs also faced challenges, dropping out of the top 20 in February before recovering slightly to 20th in March. These dynamics highlight The Standard's competitive edge in gaining market share and improving its standing among Missouri's Flower brands.

Notable Products

In March 2025, Jungle Pie (2.83g) from The Standard maintained its top position in the Flower category with notable sales of 3,479 units. Glitter Bomb (3.5g) emerged as the second best-seller, showing a strong entry with 2,818 units sold. Garlic Rage (3.5g) followed closely in third place with 2,388 units, marking its debut in the top rankings. Lemon Cherry Gelato x Cap Junky (3.5g) secured the fourth spot, while Glitter Bomb Live Badder (1g) rounded out the top five in Concentrates. This month marked the first time these products appeared in the rankings, indicating a shift in consumer preferences towards these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.