Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

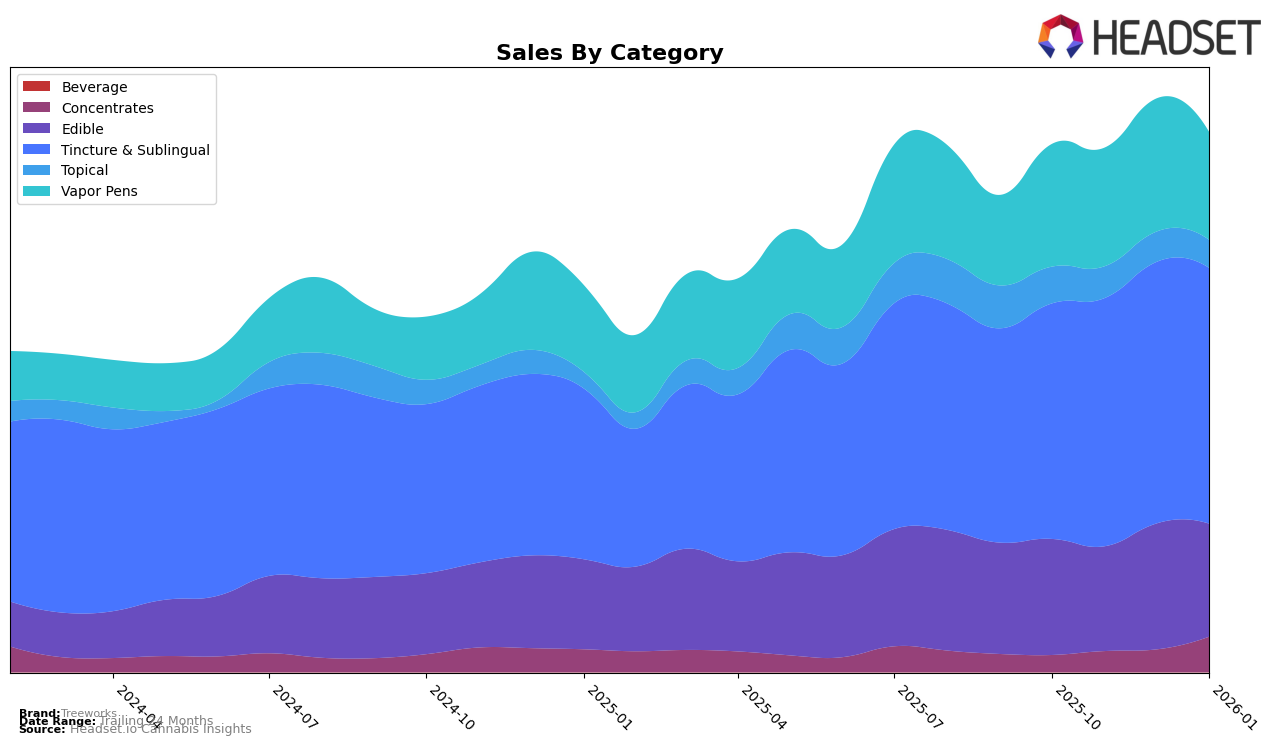

Treeworks has exhibited notable performance across various product categories, particularly in the state of Massachusetts. In the Concentrates category, Treeworks has shown significant upward momentum, climbing from the 24th position in October 2025 to the 10th by January 2026. This rise is coupled with a substantial increase in sales, indicating a strong market presence and growing consumer interest. Conversely, in the Vapor Pens category, Treeworks has maintained a relatively stable but lower ranking, hovering around the 27th to 28th positions, which suggests room for growth or a need for strategic adjustments to capture more market share.

In New Jersey, Treeworks has dominated the Tincture & Sublingual category, consistently holding the top rank from October 2025 through January 2026. This consistent performance underscores Treeworks' strong brand recognition and loyal customer base within this category. Meanwhile, the Edible category in Massachusetts has seen Treeworks maintain a steady presence around the 13th to 14th ranks, indicating a stable performance but also highlighting potential for further expansion. Notably, in the Topical category in Massachusetts, Treeworks has secured the number one spot consistently, although there has been a gradual decline in sales, suggesting a need to reinvigorate consumer interest or address competitive pressures.

Competitive Landscape

In the Massachusetts Tincture & Sublingual category, Treeworks consistently held the second rank from October 2025 to January 2026, demonstrating a stable position in the market. Despite its strong performance, Treeworks trails behind Good Feels Inc, which maintained the top rank throughout the same period with notably higher sales figures. Treeworks' sales showed a steady upward trend, indicating positive growth, but the brand still faces a significant gap compared to the leader. Meanwhile, Levia consistently held the third rank, and Howl's showed improvement by moving from fifth to fourth rank by December 2025. This competitive landscape suggests that while Treeworks is a strong contender, there is room for strategic initiatives to close the gap with the leading brand and further capitalize on its upward sales trajectory.

Notable Products

In January 2026, the top-performing product from Treeworks was the Hummies - CBD/CBG/THC 3:3:1 Happy Tropical Passionfruit Hibiscus Hash Rosin Gummies 20-Pack, maintaining its number one rank for four consecutive months with sales reaching 2750 units. The Hummies - Focus Mango Citrus Rosin Gummies 20-Pack held the second position, consistent with its rank in December 2025, though its sales slightly decreased to 1103 units. The Dream Drops - THC/CBN 1:1 Indica Bedtime Bliss Tincture moved up to the third spot from fourth in December, showing a steady increase in popularity. Hummies - Bedtime Berry Solventless Hash Rosin Gummies dropped to fourth place, a decline from its previous third position. Jungle Drops - CBD/THC/CBN/CBC/CBG 1:1:1:1:1 Blueberry Entourage Full Spectrum RSO Tincture entered the top five for the first time, indicating growing interest in full-spectrum products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.