Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

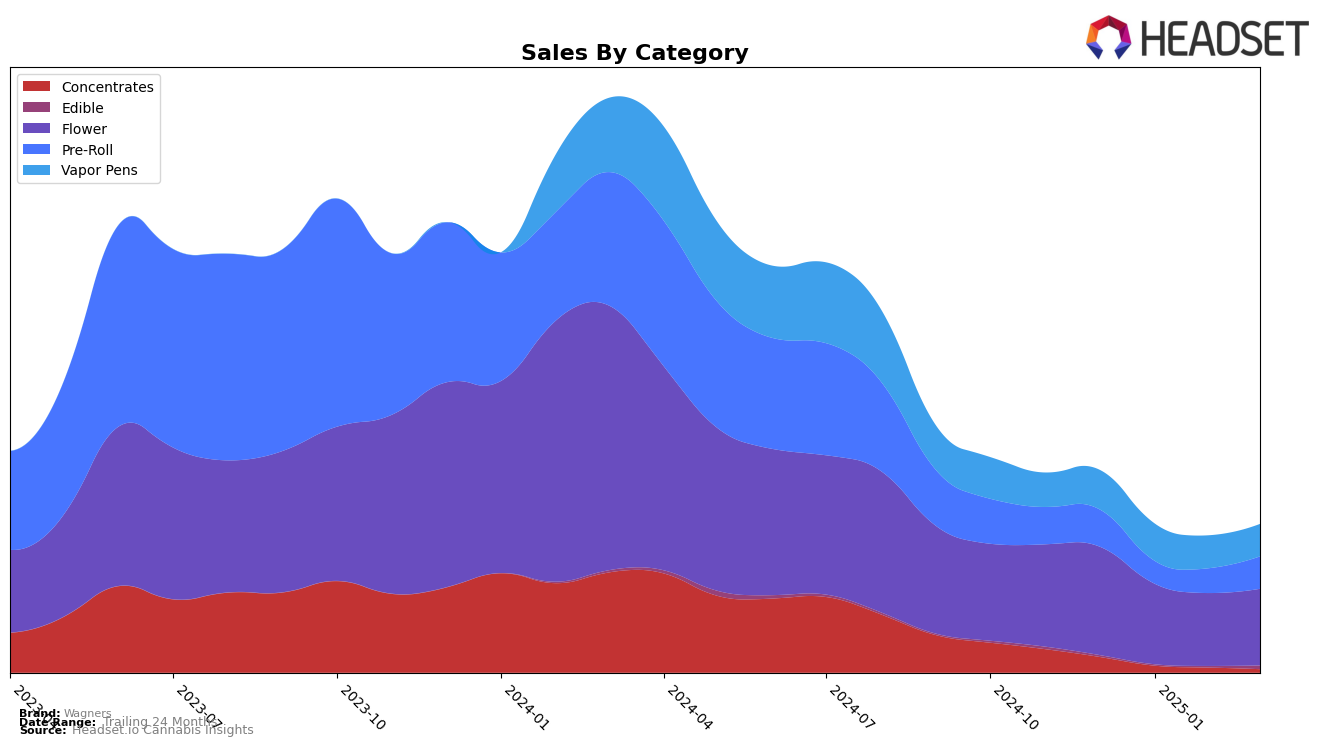

In the province of Ontario, Wagners has shown a mixed performance across different cannabis categories. The brand's presence in the Concentrates category has seen a decline, with rankings slipping from 36th in December 2024 to 52nd by March 2025. This downward trend is mirrored in sales figures, which have decreased significantly over the same period. Conversely, in the Edible category, Wagners made its debut in the top 30 in March 2025, indicating a potential area of growth and consumer interest. This suggests a strategic pivot or an emerging market trend that Wagners might be capitalizing on.

In the Flower category, Wagners has maintained a relatively stable position, holding steady at 45th place from February to March 2025, despite a slight dip in sales earlier in the year. The Pre-Roll category shows a positive trajectory, with the brand improving its rank from 99th in January 2025 to 77th in March 2025, reflecting increased consumer demand or successful marketing strategies. Meanwhile, the Vapor Pens category experienced a minor fluctuation, with Wagners dropping from 41st in January and February to 43rd in March, suggesting a competitive market environment. These movements across categories highlight the dynamic nature of Wagners' market presence in Ontario.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Wagners has shown a consistent ranking pattern, maintaining a position between 41st and 45th from December 2024 to March 2025. This stability in rank suggests a steady performance, although it indicates room for growth when compared to competitors. For instance, Color Cannabis has consistently ranked higher than Wagners, despite a downward trend from 37th to 44th over the same period. Meanwhile, Broken Coast and 5 Points Cannabis have shown more volatility, with Broken Coast improving its rank from 46th to 43rd, and 5 Points Cannabis dropping from 43rd to 48th. Notably, BC Smalls made a significant leap from 90th to 46th, indicating a strong upward trajectory that could pose a future threat to Wagners' market position. These dynamics highlight the competitive pressure Wagners faces and underscore the importance of strategic initiatives to enhance its market share and rank in the Ontario Flower category.

Notable Products

In March 2025, Wagners' Cherry Jam Pre-Roll 3-Pack (1.5g) maintained its top position as the best-selling product, with sales reaching 6957 units, showcasing consistent demand over the previous months. Pink Bubba (7g) remained steady in the second spot, continuing its strong performance observed since December 2024. Cherry Jam Super Sour Blasters Gummies 2-Pack (10mg) showed significant improvement, climbing to third place from fifth in February, indicating a growing interest in edibles. Pink Bubba Pre-Roll 3-Pack (1.5g) held its position at fourth, reflecting stable consumer preference in the pre-roll category. Lastly, Grape Quake Distillate Disposable (1g) re-entered the rankings at fifth, suggesting a resurgence in the popularity of vapor pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.