Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

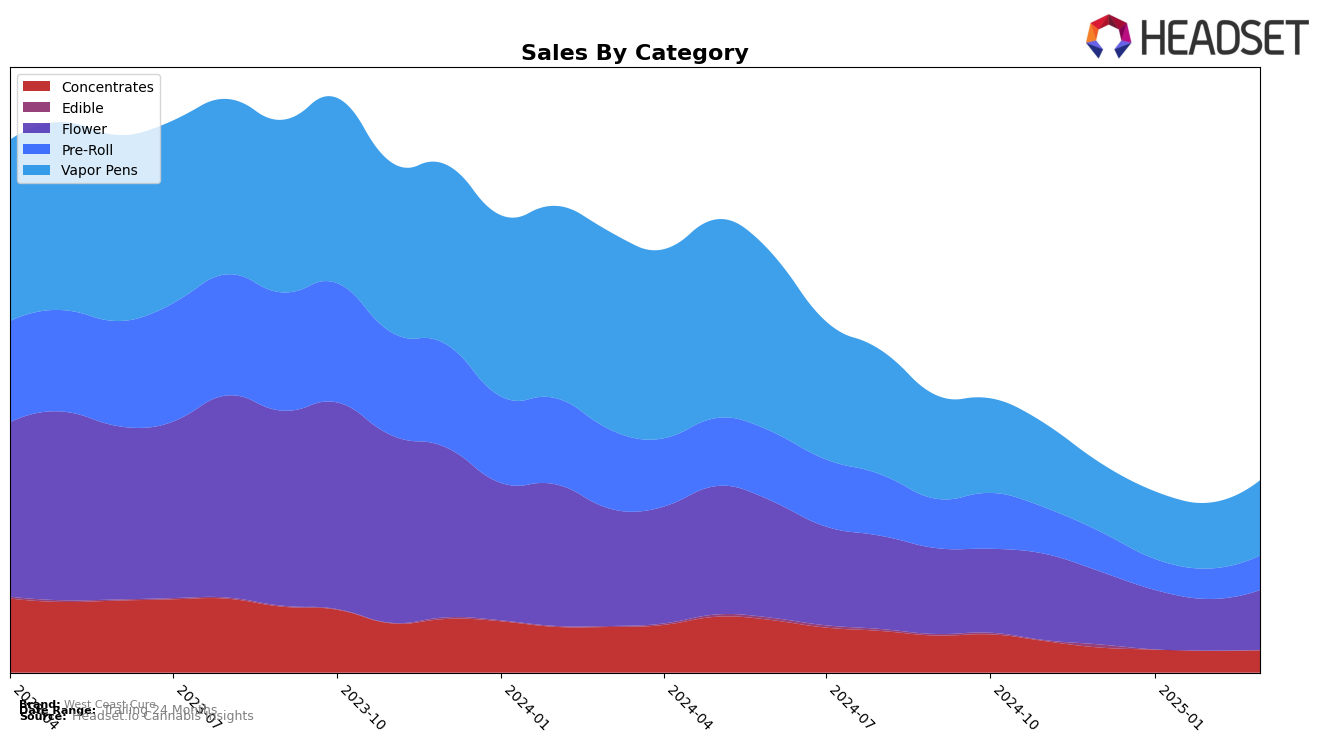

West Coast Cure has shown varied performance across different product categories in California. In the Concentrates category, they maintained a relatively stable position, fluctuating between ranks 5 and 7 from December 2024 to March 2025. This consistency indicates a solid foothold in the Concentrates market. However, their performance in the Edible category was less remarkable, as they were ranked 37th in December 2024 and did not appear in the top 30 in subsequent months, suggesting challenges in maintaining a competitive edge in this segment. The Flower category saw a slight decline in their ranking from 16th in December 2024 to 20th by March 2025. Despite this, their sales figures indicate a rebound in March 2025, hinting at potential recovery or strategic adjustments.

In the Pre-Roll category, West Coast Cure experienced some fluctuations, ranking 18th in December 2024, dropping to 22nd in January 2025, and then climbing back to 17th by March 2025. This movement suggests a competitive landscape where West Coast Cure is actively working to regain and improve its market position. The Vapor Pens category reflects a more positive trajectory, with the brand consistently holding the 16th rank for three months before improving to 14th in March 2025. This upward trend in Vapor Pens could be indicative of successful marketing strategies or product innovations that resonate well with consumers. Overall, while West Coast Cure faces challenges in certain categories, their performance in others demonstrates resilience and potential for growth.

Competitive Landscape

In the competitive landscape of the California vapor pens market, West Coast Cure has shown a notable upward trajectory in recent months. Starting from a consistent rank of 16th from December 2024 to February 2025, West Coast Cure made a significant leap to 14th place in March 2025. This improvement in rank coincides with a notable increase in sales during March, surpassing brands like Gelato, which dropped to 16th place. Meanwhile, Jeeter maintained a steady position just ahead of West Coast Cure, ranking 13th in March. Despite Dabwoods Premium Cannabis holding a consistent 12th place, West Coast Cure's recent sales surge suggests a potential for further rank advancements. The brand's ability to climb the ranks amidst strong competitors like Bloom, which remained stable at 15th, highlights its growing influence and appeal in the market.

Notable Products

In March 2025, Garlic Juice (3.5g) reclaimed its position as the top-performing product for West Coast Cure, leading in sales with a notable figure of 5743 units sold. The CUREpen - Blueberry Kush Distillate Oil Cartridge (1g) ranked second, maintaining its strong market presence with consistent sales growth over the past few months. The CUREpen - Jack Herer Oil Distillate Cartridge (1g) saw an improvement, moving up to third place from fourth in February 2025. Curepen - Pink Yum Yum Distillate Disposable (1g) entered the rankings for the first time in fourth place, indicating a new trend in consumer preference. Meanwhile, the Curepen - Cereal Milk Live Resin Cartridge (1g) held steady in fifth place, showing stable demand despite fluctuating sales figures in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.