Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

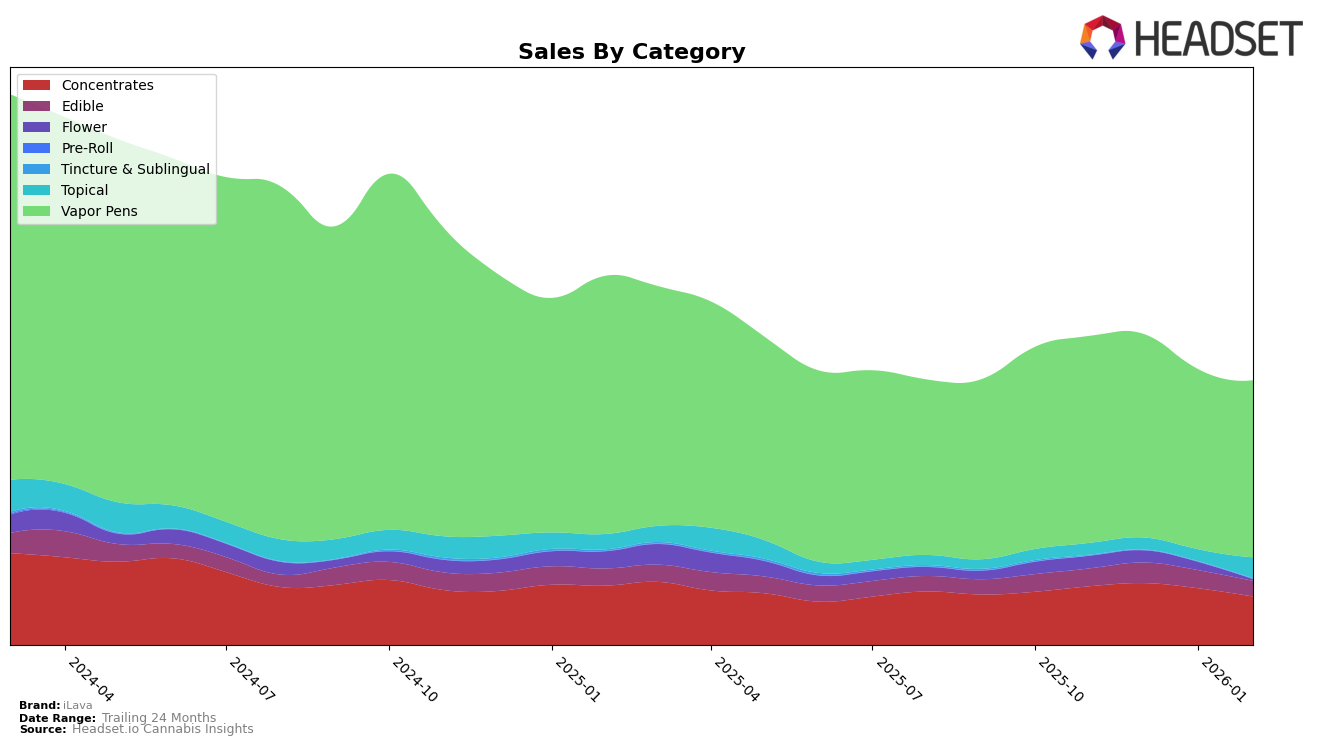

iLava has demonstrated varied performance across different product categories in Arizona. In the Concentrates category, the brand experienced a slight decline, moving from a rank of 6 in December 2025 to 10 by February 2026. This indicates a shift in consumer preferences or increased competition in the market. Conversely, iLava's Topical products made a notable leap from rank 5 in January 2026 to the top spot by February, suggesting a strong consumer demand and potential product innovation or marketing strategy that resonated well with consumers. Meanwhile, their performance in the Edibles category remained consistent, holding the 29th position from November 2025 through February 2026, indicating a stable yet unremarkable presence in that segment.

In the Vapor Pens category, iLava maintained a steady position, ranking 12th in both January and February 2026, which suggests a stable consumer base and consistent product quality. However, in the Flower category, iLava did not make it into the top 30 by February 2026, a drop from its previous 61st rank in January. This absence from the top 30 could be seen as a challenge for the brand, possibly due to a highly competitive market or shifting consumer preferences towards other forms of cannabis products. These insights offer a glimpse into iLava's strategic positioning and areas that may require attention or present opportunities for growth.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, iLava has experienced a slight decline in rank from November 2025 to February 2026, moving from 10th to 12th position. This shift is primarily influenced by the dynamic performance of competitors such as Canamo, which consistently maintained a strong position, even climbing to 10th place in December 2025. Meanwhile, Savvy made a notable leap from 17th to 10th place by February 2026, demonstrating a significant increase in sales momentum. Mohave Cannabis Co. and Grow Sciences also showed competitive resilience, with Mohave briefly surpassing iLava in January 2026. Despite these challenges, iLava's consistent presence in the top 12 underscores its established brand strength, although the sales figures indicate a need for strategic adjustments to regain higher rankings amidst intensifying competition.

Notable Products

In February 2026, the top-performing product from iLava was the Entourage Night - CBG/CBN/THC 1:1:2 Wildberry Gummies 10-Pack, which climbed to the number one rank with impressive sales of 1,228 units. This product showed a significant improvement from its third-place position in January. The Molecular - Hawaiian Dream Live Resin Disposable secured the second rank, marking its first appearance in the rankings. Lumen - Strawberry Mo'nana Sugar Wax followed in third place, also debuting in the rankings. The Entourage Night - CBD/CBN/THC 1:1:2 Blackberry Gummies moved up to fourth place, improving from fifth in January, while the Twilight - CBD/THC/CBG/CBC Blueberry Gummies maintained its position at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.